Commercial Leading Indicator Signals Positive Outlook for Commercial Real Estate in 2025

As a real estate agent specializing in commercial properties, I’m excited to share the latest insights from the BCREA Commercial Leading Indicator (CLI) for the first quarter of 2025. The data points to a promising environment for commercial real estate, which could mean great opportunities for investors, business owners, and property developers in our market.

A Strong Start to 2025

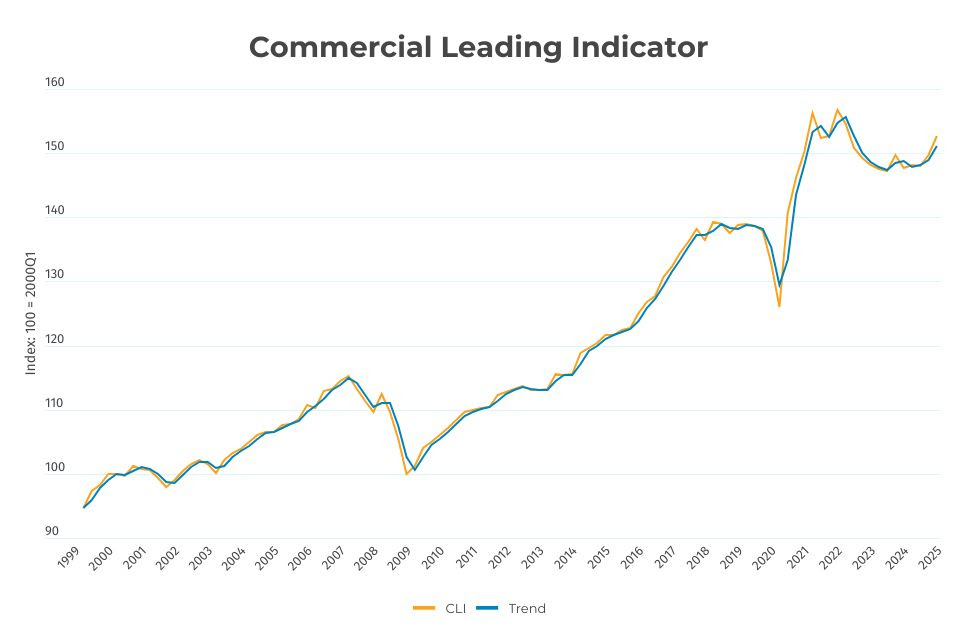

The CLI climbed 2 points to 152.6 in Q1 2025, with its six-month moving average reaching 151.1. Compared to the same period last year, the index has risen by 3.3%, reflecting a steady upward trend. This growth signals an improving economic landscape for commercial real estate, as shown in the chart below, which tracks the CLI and its trend from 1999 to 2025.

The chart illustrates the CLI’s long-term trajectory, with the index (orange line) showing a consistent rise since the early 2000s, despite some fluctuations. The trend line (blue) confirms this positive direction, with the CLI reaching its highest levels in recent years.

Key Drivers of Growth

Several components contributed to the CLI’s increase this quarter:

- Economic Activity: The economic activity index rose by 0.5 points, fueled by a 0.2% increase in inflation-adjusted retail trade and a 0.4% rise in wholesale trade. While manufacturing sales saw a slight dip, the overall growth in this sector indicates a robust start to the year for businesses, which often translates to increased demand for commercial spaces.

- Employment Growth: The employment component jumped by 1.3 points, driven by strong job creation in key sectors. Office employment grew by 0.6%, and manufacturing employment increased by 0.7%. This broad-based job growth suggests a healthy economy, likely boosting demand for office spaces, industrial properties, and other commercial real estate assets.

- Financial Conditions: The financial component of the CLI edged up by 0.1 points. Real Estate Investment Trust (REIT) prices increased by 0.6%, reflecting confidence in the commercial real estate market. Additionally, a modest decrease in interest rate spreads indicates reduced short-term economic risk, creating a more favorable environment for real estate investments. Note that this data reflects conditions before any potential tariff impacts.

What This Means for Commercial Real Estate

The upward movement in the CLI is a positive sign for anyone involved in commercial real estate. Rising economic activity and employment growth often lead to higher demand for office spaces, retail locations, and industrial properties. Meanwhile, improving financial conditions, including stable REIT prices and lower risk perceptions, suggest that now could be an ideal time to invest in or expand your commercial portfolio.

Let’s Connect to Explore Opportunities

Whether you’re looking to lease, buy, or invest in commercial real estate, these favorable conditions present a window of opportunity. As your trusted real estate agent, I’m here to help you navigate the market and find the perfect property to meet your goals. Let’s connect to discuss how you can take advantage of this promising outlook for 2025!

Categories

Recent Posts

GET MORE INFORMATION