Victoria BC Real Estate: Navigating the Rental Market and Borrowing Costs

The housing market is influenced by key factors like rental prices and borrowing costs, which impact renters and homebuyers alike. Using recent data, this blog examines trends in asking rents for 1- and 2-bedroom units in Victoria and Vancouver, alongside changes in mortgage rates across Canada. By analyzing these metrics, we can better understand the dynamics shaping housing decisions in 2025. Let’s dive into the numbers and explore what they reveal.

Rental Market Trends

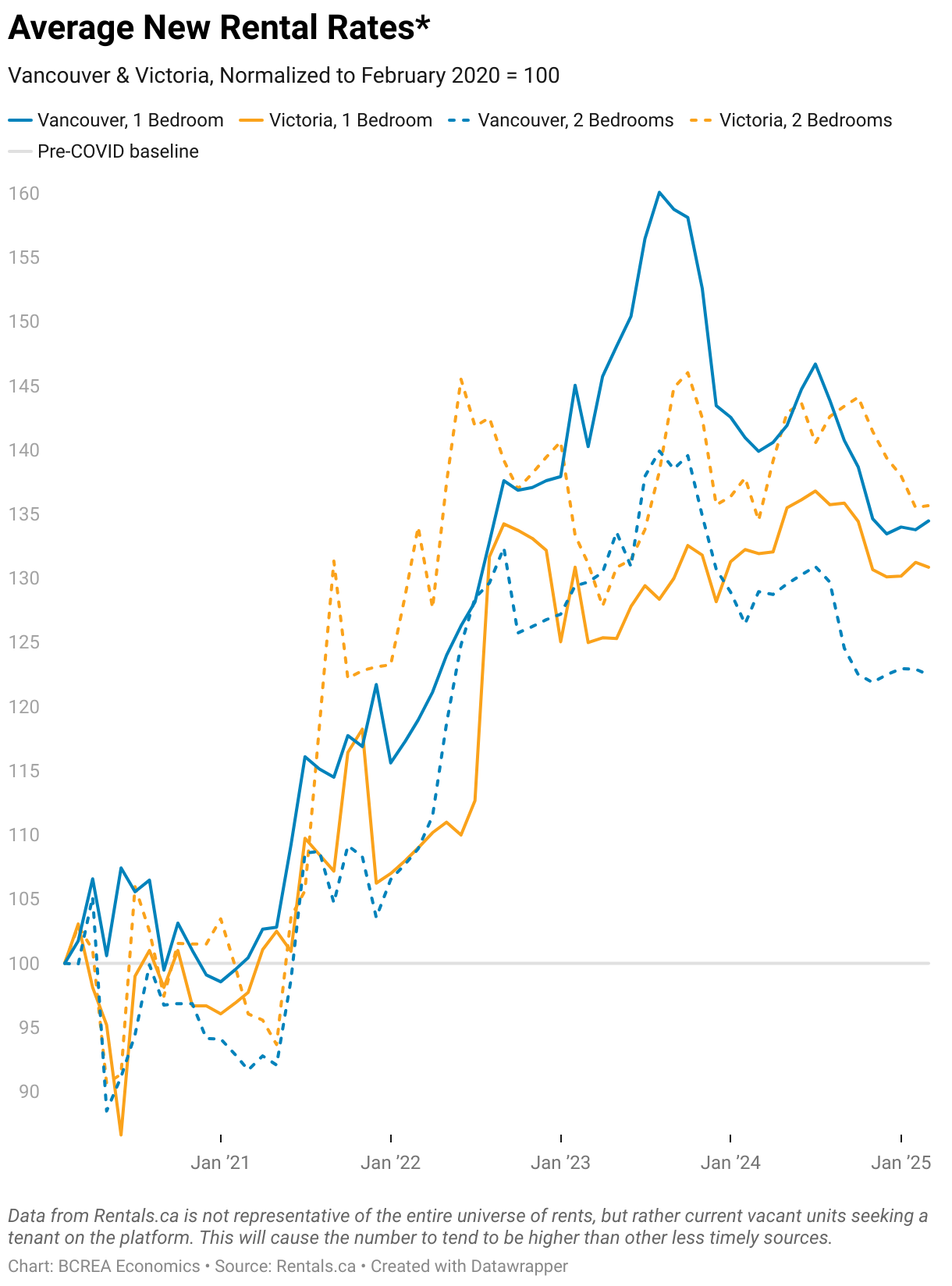

The rental market has seen significant changes, as shown in the chart below from Rentals.ca. The chart tracks the average asking rents for vacant 1- and 2-bedroom units in Victoria and Vancouver, normalized to February 2020 levels (set at 100). These asking rents reflect what new tenants would pay, which is typically higher than what existing tenants pay due to landlords raising rates for new leases.

By January 2025, asking rents for 1-bedroom units in Victoria (orange solid line) have risen to 135% of their February 2020 levels—a 35% increase over five years. For 2-bedroom units in Victoria (orange dashed line), rents have increased to 130%, a 30% rise. In Vancouver, 1-bedroom units (blue solid line) peaked at 155% in mid-2023 before settling at 140% by January 2025, while 2-bedroom units (blue dashed line) reached 145% and ended at 135%. Victoria’s rental rates show a steady upward trend with fewer fluctuations than Vancouver, where rents surged more dramatically during 2022-2023 before moderating. This suggests a competitive rental market, with new tenants facing significantly higher costs compared to five years ago.

Borrowing Costs and Their Impact

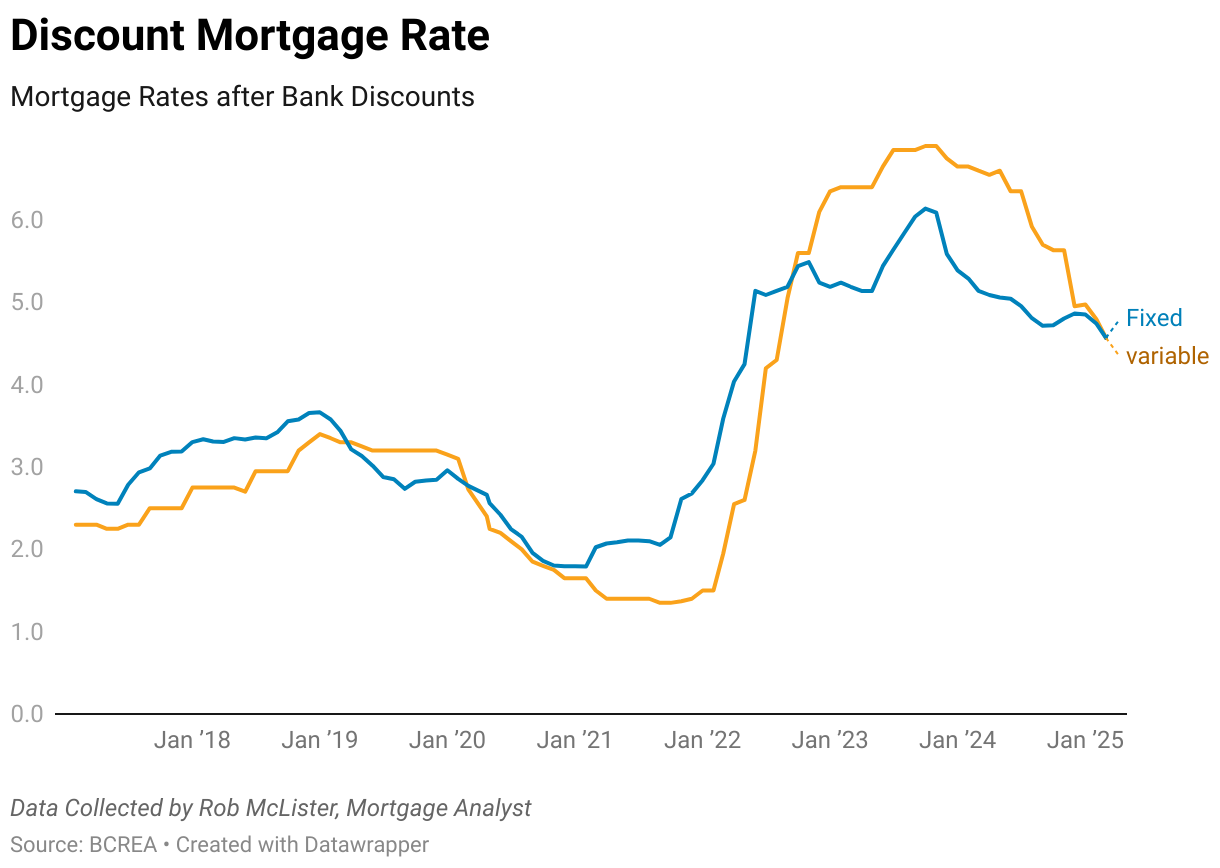

Mortgage rates are a critical factor in the housing market, affecting borrowing costs for homebuyers. The chart below tracks the average fixed and variable mortgage rates in Canada after bank discounts, showing trends from 2018 to 2025.

The chart indicates that fixed mortgage rates (blue line) started at 3% in January 2018, dropped to 2% in 2020 during the pandemic, peaked at 5.5% in mid-2023, and declined to 4% by January 2025. Variable rates (orange line) began at 2.5% in 2018, fell to 1.5% in 2020, rose to 5% in 2023, and settled at 3.5% by January 2025. The recent decline in rates from their 2023 highs suggests improved affordability for homebuyers. Fixed rates at 4% are now more favorable than the 5.5% peak, and variable rates at 3.5% offer a slightly lower option for those willing to take on rate fluctuation risks. These trends indicate a potential window for buyers to secure financing at relatively lower costs compared to recent years.

Conclusion

The data reveals a housing market where rental and borrowing costs have evolved significantly. Asking rents in Victoria and Vancouver have risen sharply since February 2020, with 1-bedroom units up 35% and 2-bedroom units up 30% in Victoria, and 40% and 35% in Vancouver by January 2025. Meanwhile, mortgage rates have eased to 4% (fixed) and 3.5% (variable), offering some relief for buyers after peaking in 2023. These trends highlight a competitive rental market for new tenants and a more favorable borrowing environment for homebuyers, shaping key considerations for housing decisions in 2025.

Categories

Recent Posts

Bank of Canada Interest Rate Announcement – December 10, 2025

Mortgage Rate Forecast (December 2025)

Canadian Employment (November 2025)

November 2025 Victoria Real Estate Market Stats

BC Monthly Real GDP Estimate for September 2025 & Preliminary Estimate for October 2025

Canadian Economic Growth (Real GDP Q3 2025)

Canadian Retail Sales (September 2025)

Canadian Housing Starts (October 2025)

Canadian Inflation (October 2025)

BC Housing Market Activity Strengthening into the Closing Months of 2025

GET MORE INFORMATION