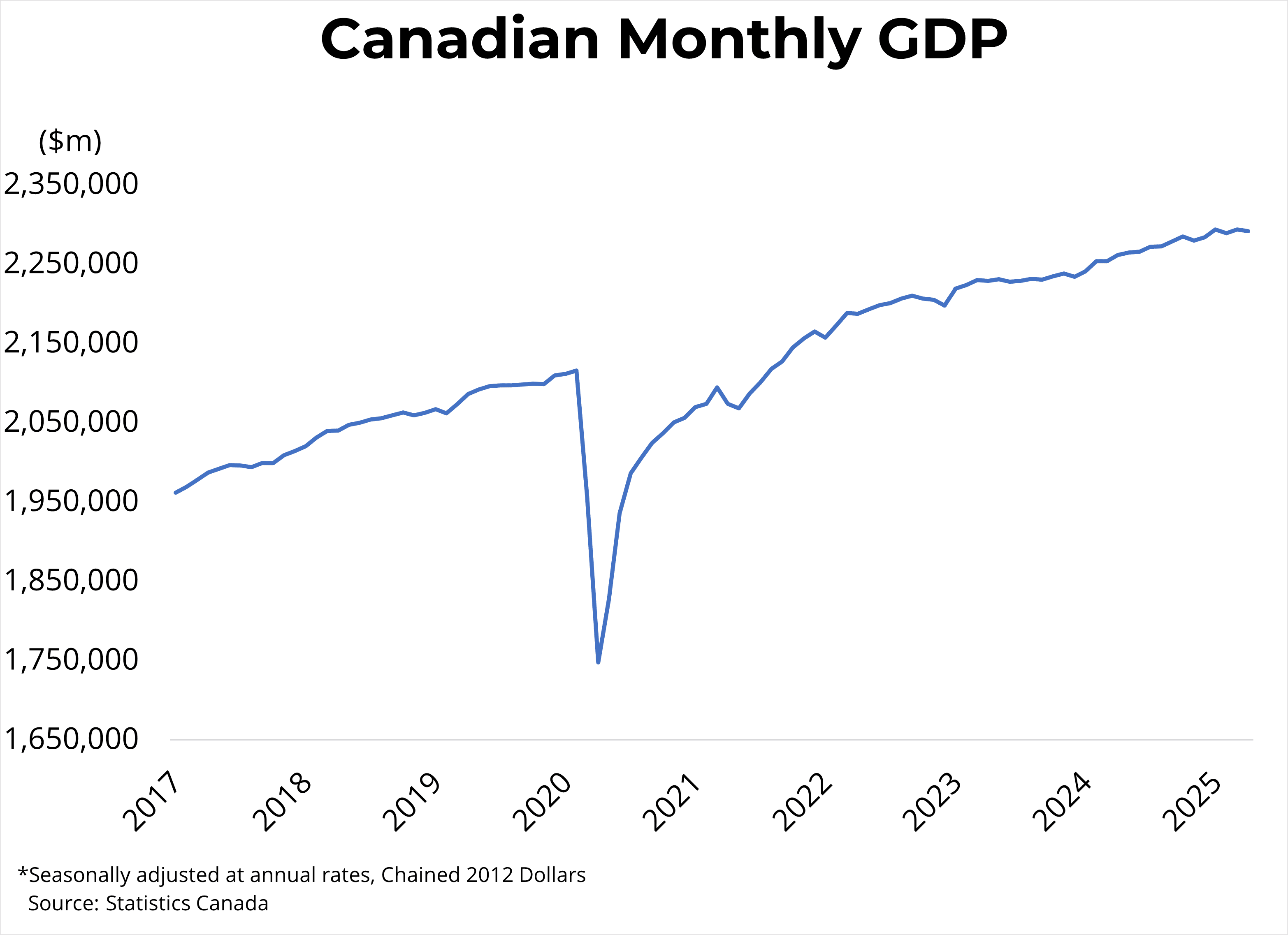

Canadian Economic Growth – April 2025

Canada’s economy showed signs of softening in April, with real GDP contracting by 0.1%, according to Statistics Canada. This decline followed a modest 0.2% gain in March, signaling a potentially rocky start to the second quarter.

🔍 A Mixed Picture: Services Up, Goods Down

April’s data reveals a clear divide between sectors:

-

Service-producing industries grew by 0.1%, offering some stability.

-

Goods-producing industries fell by 0.6%, weighed down by:

-

Manufacturing: -1.9%

-

Wholesale trade: -1.9%

-

These sectors—closely tied to trade with the U.S.—bore the brunt of ongoing tariff uncertainty, particularly in motor vehicle manufacturing and distribution.

Source: Statistics Canada | Seasonally adjusted at annual rates, chained 2012 dollars

🏡 Positive News for Real Estate

Despite the broader economic contraction, there was positive movement in real estate:

-

GDP for offices of real estate agents and brokers rose 1.3% month-over-month in April.

This growth reflects continued activity and optimism in the housing market, particularly in regions like British Columbia, where many buyers and sellers are still taking advantage of relatively stable mortgage conditions ahead of potential rate cuts.

📉 Looking Ahead: Will the Bank of Canada Cut Rates?

This slight contraction marks the beginning of what could be a flat or negative quarter. The impact of tariffs is now reversing earlier gains, as businesses adjust their exports and supply chains in anticipation of slower demand.

While the Bank of Canada previously forecasted flat Q2 growth, the combination of:

-

Weak April GDP,

-

Early signs of a May contraction, and

-

Still-elevated core inflation,

puts the Bank in a tough spot.

Markets are now leaning toward a rate cut in July, but uncertainty remains high. Next month’s CPI and GDP releases will play a crucial role in shaping monetary policy.

💬 What Does This Mean for You?

As a real estate professional in Victoria, BC, I watch these economic trends closely. Rate decisions directly affect mortgage affordability, buyer sentiment, and overall activity in the housing market.

If you're considering buying or selling, or you just want to make sense of how the economy may impact your next move, I’d be happy to chat. Let’s connect and make smart, informed decisions together.

Florencio Mende Jr

📍 Victoria, BC Realtor | Real Broker

📩 florenciomendejr@gmail.com

📞 250-882-1986

Categories

Recent Posts

GET MORE INFORMATION