Bank of Canada Holds Rates Steady Amid Trade Uncertainty and Rising Inflation

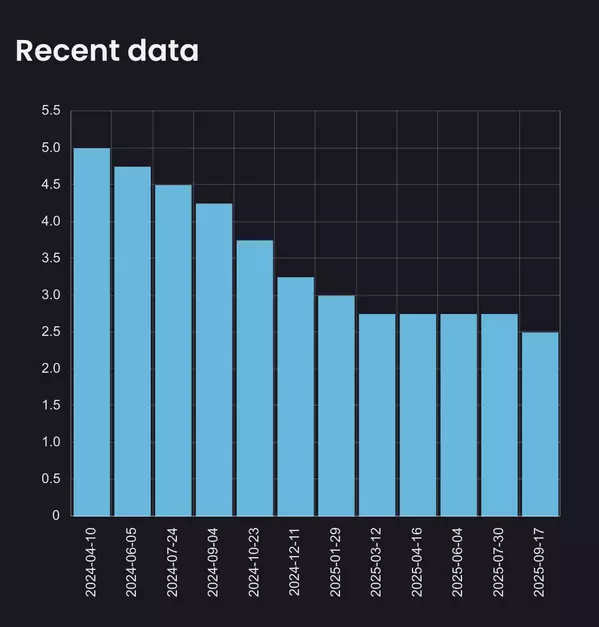

This morning, the Bank of Canada opted to keep its overnight policy rate unchanged at 2.75%, reflecting a cautious approach amid turbulent economic signals. The Bank’s statement pointed to U.S. trade policies as a persistent source of global uncertainty, warning that this could dampen economic growth in the months ahead. Meanwhile, inflation is proving stickier than hoped, with April’s data exceeding expectations and household surveys revealing growing fears of price hikes driven by potential tariffs. Core inflation measures, now running above 3% on a three-month annualized basis, underscore the mounting challenge.

The Stagflation Risk

Trade wars are a known recipe for stagflation—a slowdown in growth paired with rising prices. While the extent of any looming trade conflict remains unclear, its mere possibility is already freezing decision-making. Businesses are holding off on hiring and investments, and families are hesitating to buy or sell homes. The impact is tangible: Canada’s job market is cooling, and housing activity has taken a hit.

This dual threat of sluggish growth and climbing inflation puts the Bank of Canada in a tough spot. Acting to cool prices could choke the economy further, while standing still risks letting inflation run unchecked.

A Rate Cut on the Horizon?

With unemployment creeping up and the specter of a broader economic downturn looming, we expect the Bank to pivot soon. A rate cut is likely at the July meeting, offering some relief to a faltering economy while navigating the tightrope of persistent inflation.

As trade tensions and price pressures continue to shape Canada’s economic outlook, the Bank’s next steps will be critical. Keep an eye on this space for updates on how policymakers tackle these challenges.

Categories

Recent Posts

GET MORE INFORMATION