Victoria BC Real Estate: Construction Trends and Housing Market Insights (2010-2025)

The Victoria BC real estate market has long been a focal point for homebuyers, investors, and REALTORS® due to its picturesque landscapes, vibrant community, and strong demand for housing. As part of British Columbia’s dynamic housing landscape, understanding construction trends—such as housing starts, units under construction, completions, and completion times by property type—offers critical insights into how new supply shapes the market. With Victoria often leading price growth in regions like Vancouver Island, as seen in prior analyses, these construction metrics are essential for assessing how quickly new homes can meet demand, stabilize prices, and improve affordability in the region. This blog delves into BC’s construction trends from 2010 to 2025, with a focus on their implications for Victoria’s real estate market.

The Role of Construction in the Housing Market

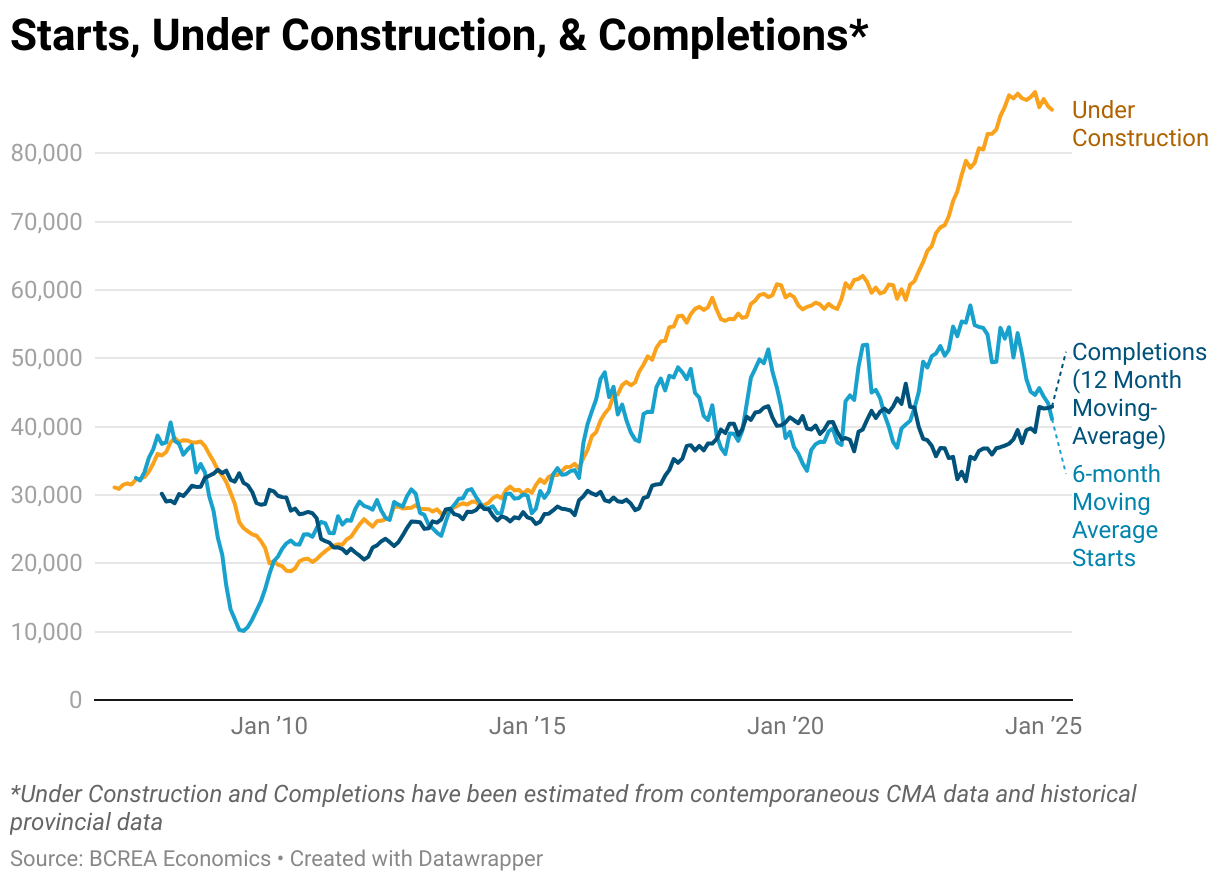

Home construction, as measured by starts, units under construction, and completions, plays a pivotal role in British Columbia’s housing market. These metrics are vital for REALTORS® as they directly influence the provincial housing stock and eventually feed into the resale market. A housing start marks the moment when concrete is poured for a structure’s footing (or an equivalent stage for non-basement builds), while a unit remains under construction from the start until completion. Construction is the primary mechanism for introducing new supply into the market, which is essential for stabilizing prices and maintaining affordability over the long term. In BC, the number of units under construction typically exceeds starts and completions due to the extended duration of the construction process, which has been trending upward in recent years. Notably, BC also experiences longer average completion times compared to most other Canadian provinces, reflecting unique challenges in the region’s housing development landscape.

Starts, Under Construction, and Completions in British Columbia

The graph illustrates housing starts, units under construction, and completions in British Columbia from January 2010 to January 2025, with data estimated from CMHC and historical provincial records. Starts and completions (tracked as 6-month moving averages) hover between 10,000 and 50,000 units throughout the period, showing significant volatility. A sharp dip occurs around 2010, likely due to the aftermath of the global financial crisis, with starts and completions dropping below 10,000. Both metrics recover by 2015, fluctuating between 20,000 and 40,000, with a notable peak in completions around 2020-2021, reaching nearly 50,000, possibly driven by increased demand during the pandemic housing boom. Meanwhile, units under construction show a steady upward trend, starting around 30,000 in 2010 and climbing to over 80,000 by 2025. This consistent rise reflects longer construction timelines in BC, as projects take more months to complete compared to other provinces, contributing to a growing backlog of units in the construction pipeline. This trend underscores the challenge of delivering new supply quickly enough to meet demand, impacting affordability and market dynamics in the region.

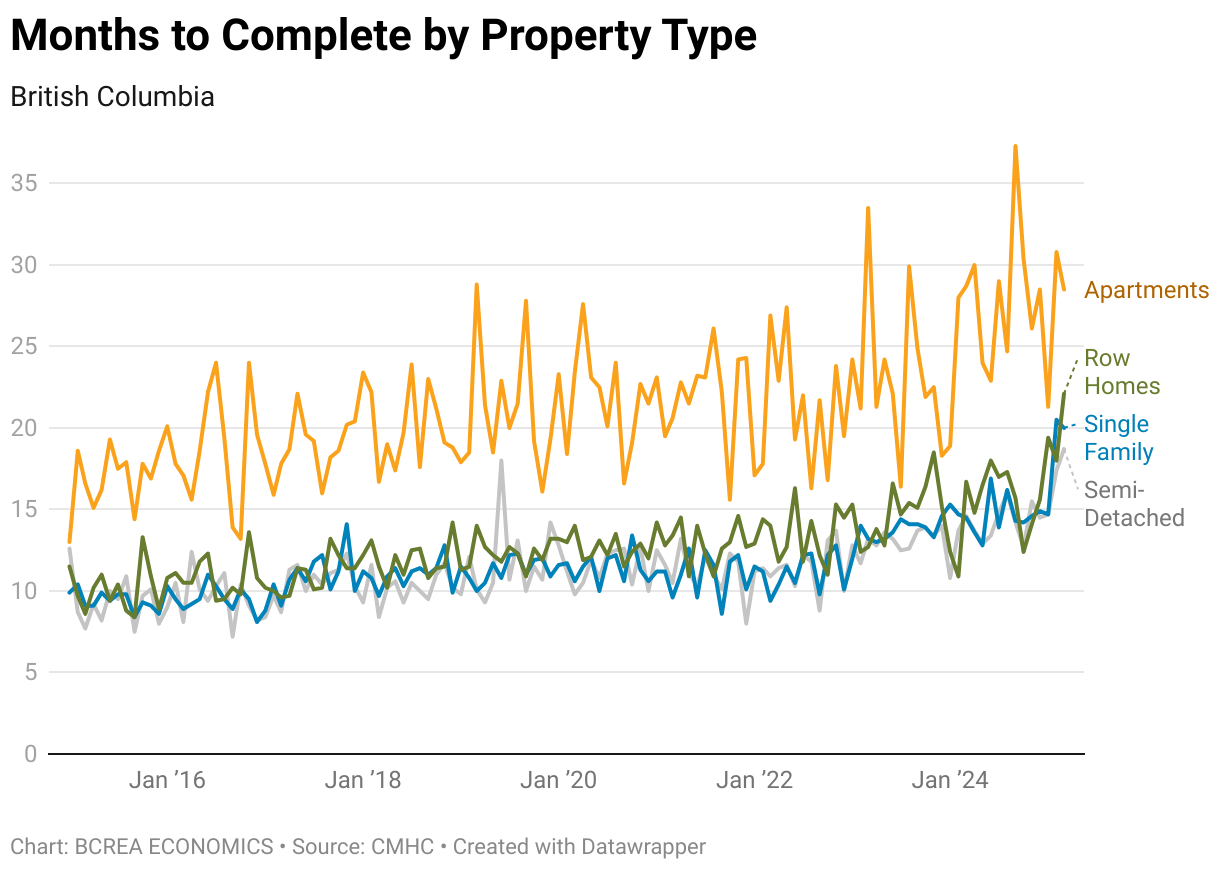

Months to Complete by Property Type in British Columbia

The graph depicts the average months to complete construction by property type in British Columbia from January 2016 to January 2024, covering apartments, row homes, single-family homes, and semi-detached homes. Apartments consistently take the longest to complete, starting around 15 months in 2016, peaking at over 30 months around 2020, and surging again to nearly 35 months by 2024, reflecting the complexity and scale of multi-unit projects, especially in urban areas like Victoria and the Lower Mainland. Row homes show a similar upward trend, rising from about 10 months in 2016 to around 20 months by 2024, indicating growing construction delays in this segment as well. In contrast, single-family and semi-detached homes require less time, fluctuating between 5 and 15 months throughout the period, with a slight upward trend toward 2024, reaching around 10-12 months. This disparity highlights how larger, multi-unit developments like apartments face greater delays—possibly due to regulatory hurdles, labor shortages, or supply chain issues—while smaller-scale projects remain relatively faster to complete. The overall increase in completion times across all property types underscores BC’s broader trend of extended construction timelines, posing challenges for addressing housing supply and affordability.

Conclusion

For Victoria BC real estate, the construction trends from 2010 to 2025 reveal both opportunities and challenges. The steady rise in units under construction signals a robust pipeline of new homes, particularly important for a high-demand market like Victoria, where prior analyses showed Vancouver Island leading in active listings and house price growth. However, the increasing months to complete—especially for apartments, which are critical for urban density in Victoria—highlight significant delays that could hinder the timely delivery of new supply, exacerbating affordability issues. As Victoria continues to attract buyers with its unique appeal, addressing these construction bottlenecks will be key to balancing supply and demand, ensuring the market remains accessible for residents and investors alike in the years ahead.

Categories

Recent Posts

GET MORE INFORMATION